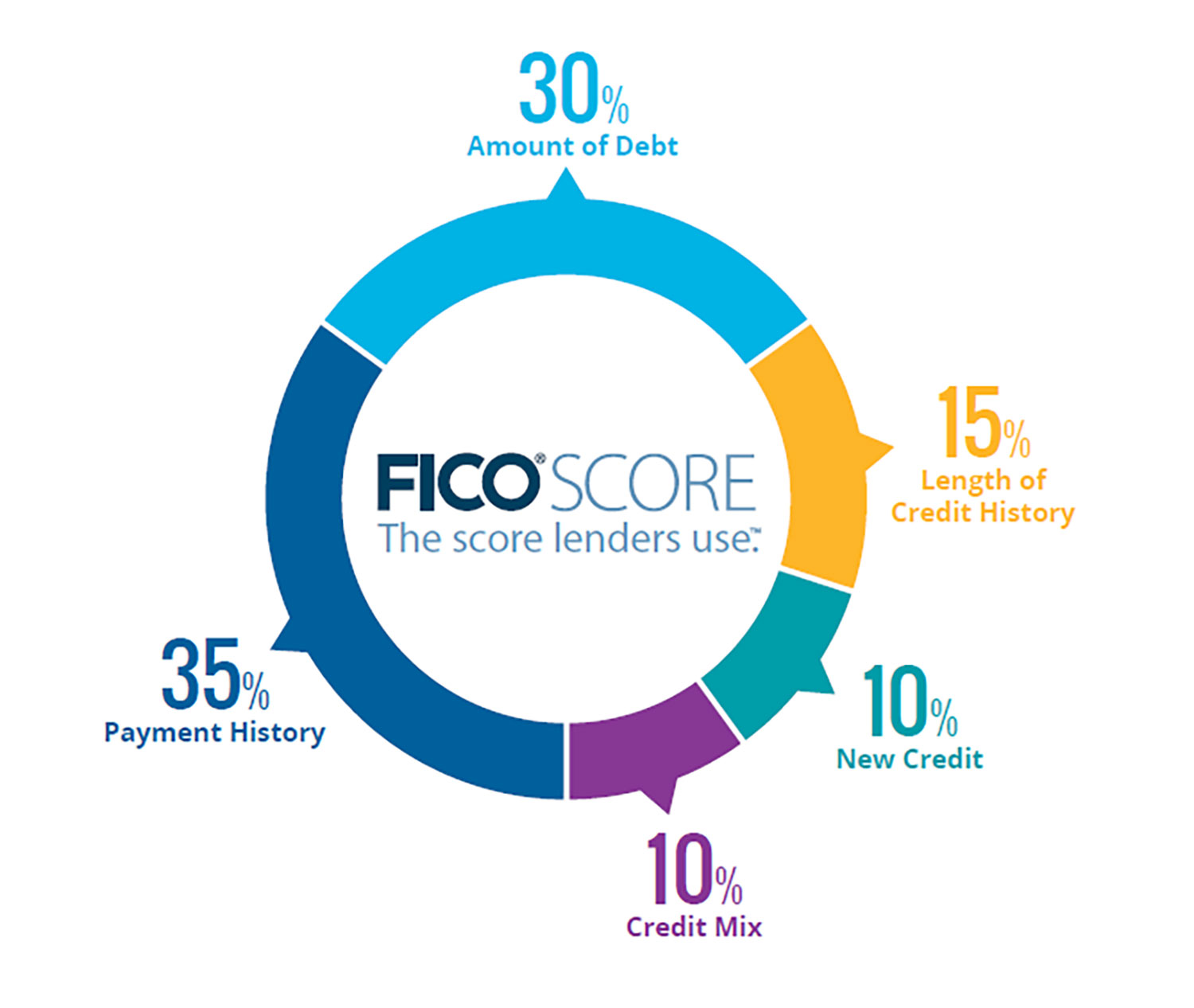

Credit mix is 10% of your credit score. FICO Scores will consider your mix of credit cards, retail accounts, installment loans, finance company accounts and mortgage loans. It's not necessary to have one of each, and it's not a good idea to open credit accounts you don’t intend to use.

The credit mix usually won’t be a key factor in determining your Credit Scores, however, it will bemore important, especially if your credit report does not have a lot of other information on which to base a score.

Having credit cards and installment loans with a good credit history will raise your Credit Scores. People with no credit cards tend to be viewed as a higher risk than people who have managed credit cards responsibly.

If you're in need of credit establishment or restoration services, contact us today to speak with a certified credit consultant.

#nocredit #badcredit #crediteducation #financialfreedom #800club #debtfree #creditisking